Here is the rewritten content:

The United States and Europe have been reviving their industrial capabilities after decades of downsizing and outsourcing to countries like China. In this context, a rapidly growing Polish startup, Nomagic, which specializes in building robots for logistics operations, has secured $44 million in funding. This investment will be utilized for both technological and business development, including expanding its customer base to regions outside Europe, specifically North America.

The significance of this investment lies not only in its size, which is the largest round for Nomagic to date, but also in the investors involved and the current industrial landscape.

A fundamental question arises when considering how to revitalize industrial competitiveness: what approach should be taken? The workforce that previously operated factories and warehouses has either moved to other industries or been reduced to cut costs and increase efficiency through automation.

The controversy surrounding the balance between human workers and technological innovation to improve efficiency has sparked intense debate, as seen in the viral story about a Y Combinator startup that developed an AI-based workplace observer to monitor employee productivity, dubbed a “sweatshop as a service” by critics.

While outrage may not halt the development of such technologies or render humans obsolete in certain functions, it highlights the ongoing struggles and debates surrounding the issue.

Nomagic’s funding, in part, signals how some investors envision the future of industry.

The European Bank for Reconstruction and Development (EBRD), a development bank co-owned by over 70 countries and two European Union institutions, is leading this Series B funding round.

The EBRD’s involvement underscores the efforts of governments and institutions to support private businesses in rebuilding industry, recognizing the importance of robotics and technology in enhancing European competitiveness.

In addition to the EBRD, prominent existing investors Khosla Ventures and Almaz Capital are participating, and the European Investment Bank (EIB) is providing venture debt, aligning with its institutional mission.

According to PitchBook data, Nomagic had previously raised around $30 million. While the startup and investors declined to disclose the valuation, Khosla partner Kanu Gulati confirmed to TechCrunch that it was an “up round” for the company. We have previously profiled Nomagic and its technology here and here.

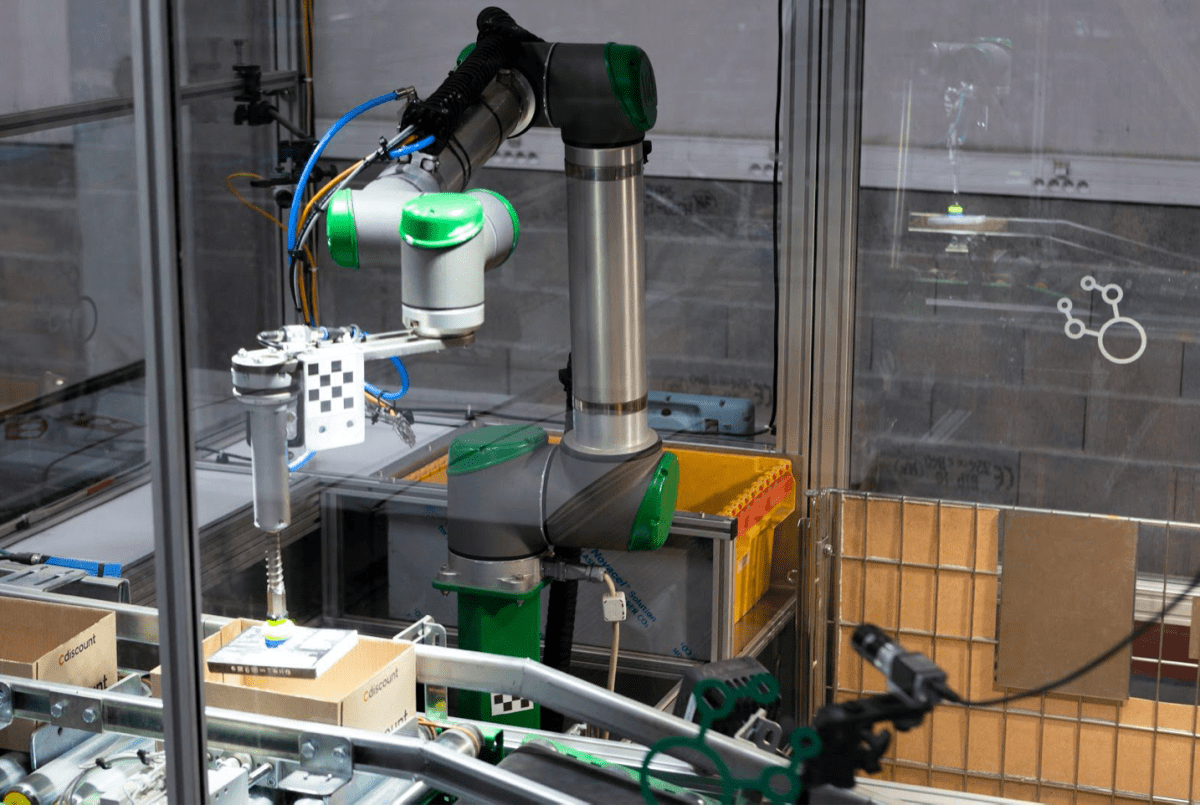

Notably, Nomagic’s robotic arms do not represent a breakthrough in hardware, but rather a focus on software development.

“Most of our hardware is off the shelf,” said Kacper Nowicki, CEO and co-founder of Nomagic, in an interview.

The company has developed a “library” of objects and their handling procedures using computer vision, machine learning, and automation, enabling its robots to be easily redeployed across various use cases.

Nomagic has achieved 220% growth in annual recurring revenue over the past year and expects another 200% growth this year, driven by demand from new and existing customers in e-commerce and pharmaceuticals.

The company’s customers include Apo.com, Arvato, Asos, Brack, Fiege, Komplett, and Vetlog.one.

Nomagic’s closest competitor, Covariant, recently partnered with Amazon, which hired the startup’s founders and secured a major licensing deal, valuing Covariant at around $625 million in 2022.

Companies like Nomagic, Covariant, Berkshire Grey, and RightHand Robotics are developing their technologies as robotics becomes increasingly prominent in industrial environments.

Major players like Nvidia and SoftBank, which acquired Berkshire Grey in 2023, have identified the opportunity to build for this market, driven by the upgrading of legacy equipment and the construction of new manufacturing and logistics facilities.

The role of government in this trend should not be overlooked, as regions like the U.K., the European Union, and the U.S. are investing heavily in industry and calling for further investment.

Source Link