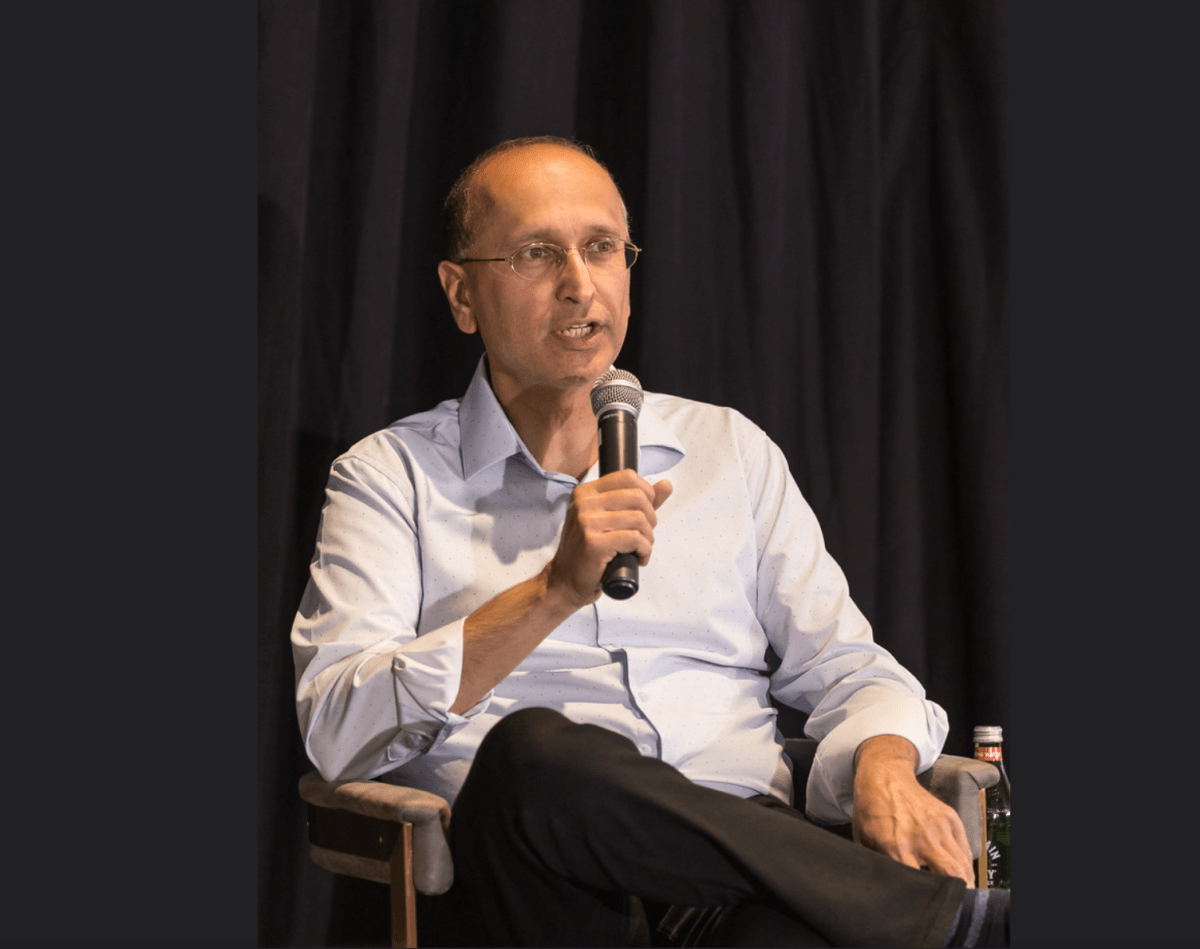

Navin Chaddha, the managing director of the 55-year-old Silicon Valley venture firm Mayfield, is placing a significant bet on the ability of AI to revolutionize industries that are heavily reliant on human labor, such as consulting, law, and accounting. Chaddha, a seasoned investor with a track record of success that includes companies like Lyft, Poshmark, and HashiCorp, recently shared his insights at TechCrunch’s StrictlyVC evening in Menlo Park on why he believes “AI teammates” can generate software-like margins in traditionally labor-intensive sectors. He also emphasized the importance of targeting neglected markets rather than competing directly with giants like Accenture, while acknowledging the challenges of disrupting industries where relationships and trust are crucial. This conversation has been lightly edited for length and clarity.

Can you elaborate on your assertion that law firms, consulting companies, and accounting services – a collective $5 trillion market – will undergo a complete transformation due to AI-first companies operating with software-like margins? What tangible evidence do you have beyond theoretical presentations?

One of the advantages of being a firm with over 50 years of history is that we’ve witnessed all the major trends, from mainframes to minicomputers, PCs, the internet, mobile, cloud, social, and now the AI era. A notable example from the late ’90s is the rise of e-business, which forced physical businesses to adapt to a click-and-mortar model to survive. Similarly, trends like outsourcing and offshoring led to the emergence of countries like India as hubs for software services. In the context of AI, we’re seeing a 100x force that is teaming up with humans to enhance their capabilities and reimagine businesses.

The integration of AI will lead to two primary models: organic growth and inorganic growth through acquisitions. Many repetitive tasks will be automated, freeing humans to focus on higher-value tasks.

Could you provide a specific example of how AI will transform these industries?

Consider the implementation of Salesforce. Traditionally, a human would oversee this process. However, with AI, the human client manager can work alongside AI to execute the implementation. The AI acts as the primary workforce, with the human stepping in only when necessary. This hybrid approach enables more efficient use of resources and reduces costs for clients, who only pay for the AI services they use.

Rather than competing directly with large consulting and IT firms like Accenture, startups should focus on serving the neglected masses. There are approximately 30 million small companies in the U.S. and 100 million worldwide that cannot afford traditional knowledge workers. By offering services as software, these companies can access essential tools like receptionists, schedulers, and website builders at a fraction of the cost. The pricing model shifts from hourly or monthly to event-based, providing a more cost-effective solution for these underserved markets.

This sounds like outcome-based pricing rather than traditional time-based billing.

Exactly. Outcome-based pricing is similar to cloud billing or electricity billing, where you pay only for what you use. If 80% of the work is done by AI, the gross margin can be as high as 80% to 90%. humans can still maintain a 30% to 40% margin. By blending these models, companies can achieve margins of 60% to 70% and net income of 20% to 30%. This is in stark contrast to many tech companies, which often rely on venture capital and public market funding.

You recently led the Series A round for Gruve, an AI tech consulting startup. What impressed you about their early customer pilots?

Gruve’s founders have a proven track record, having bootstrapped two previous services companies to $500 million in revenue and $50 to $100 million in profits. They acquired a $5 million security consulting company and applied AI to grow it to $15 million in revenue within six months, achieving an 80% gross margin. Their outcome-based model has resonated with customers, including Cisco, who appreciate the cost savings and efficiency gains.

Can’t established companies like McKinsey simply acquire these AI capabilities to stay competitive?

While it’s possible for large firms to acquire AI capabilities, the innovator’s dilemma often prevents them from fully embracing new business models. For instance, when enterprise software companies shifted from perpetual licenses to SaaS models, many struggled to adapt due to the significant change in revenue streams. Similarly, companies like McKinsey and Accenture may find it challenging to transition to an outcome-based AI model, which would require them to rethink their pricing and service delivery. This creates an opportunity for new entrants to target neglected markets and establish themselves before the larger firms can adapt.

However, it’s inevitable that these large companies will also undergo transformation. The smaller companies that are not competing with them today will eventually become their competitors in the future. The key for startups is to identify unique go-to-market strategies and serve customers that the larger firms cannot or will not serve.

You allocated $100 million from your recent funds to focus on “AI teammates.” What differentiates a true AI teammate from an AI tool?

At Mayfield, we define an AI teammate as a digital companion

Source Link