The Rising Importance of AI in Fintech: A Key to Mitigating Online Fraud

Online fraud has become a significant challenge in India’s digital landscape. In the first half of 2024, the country witnessed a surge in cyber fraud, with citizens losing over ₹11,000 crore (approximately $1.3 billion) to online scams, averaging around ₹60 crore (approximately $7.2 million) per day (source). While these statistics are becoming increasingly common, a robust fintech infrastructure holds the key to stemming this unmitigated rise of scams. As technology and our interactions with money evolve, AI and GenAI are no longer just buzzwords; they are foundational to how modern fintech systems operate, enhancing security from user verification to transaction safety.

Today, AI models are deeply embedded in consumer interfaces and mission-critical backend systems. GenAI, once considered experimental, is now production-grade and transforming how businesses function. This shift is particularly visible in fintech, where the combination of speed, security, and personalization is becoming non-negotiable.

Why AI Matters in Fintech

Fintech has always thrived on data, but in today’s landscape, raw data alone is no longer sufficient. The real game-changer is how that data is processed and applied. This is where AI and GenAI are stepping up as the driving forces behind smarter decision-making, proactive fraud detection, and hyper-personalized user experiences. Modern fintech infrastructure is now defined not just by speed but by trust and tailored experiences – two areas where AI excels.

AI is making what was once seen as a "nice to have" mission-critical. Components such as document verification, fraud detection, and intelligent onboarding are now essential for digital commerce, not just for security but also from a compliance standpoint. AI makes this possible, at scale, and in real-time, reducing human error and enhancing security. Whether it’s preventing identity fraud or mitigating transaction risks, AI in fintech is working behind the scenes to build a more secure digital economy.

GenAI in Action: High-Impact Fintech Use Cases

The beauty of GenAI lies in its versatility. It can take a myriad of traditionally manual, error-prone processes and automate them with exceptional accuracy and speed. Practical applications include:

- Document Verification: GenAI has redefined how documents are processed, from uploading and classifying to extracting and verifying data, drastically cutting down onboarding time and fraud risk.

- Fraud Detection: AI models excel at detecting forged documents and unusual behaviors, outperforming traditional rule-based systems, leading to faster, more precise fraud prevention.

- Face & Name Match: Advanced algorithms now cross-verify identities from photos, documents, and databases, making KYC and AML processes faster and more reliable.

- Smarter COD Management with AI: GenAI predicts risky orders using behavioral and location data, enabling dynamic COD decisions based on customer trust scores, helping reduce RTO while maintaining conversions and protecting profitability.

- Proactive Fraud Detection: AI and ML algorithms analyze large volumes of payment data to detect suspicious activity in real-time, including patterns like UPI fraud, identifying and preventing threats before they affect businesses.

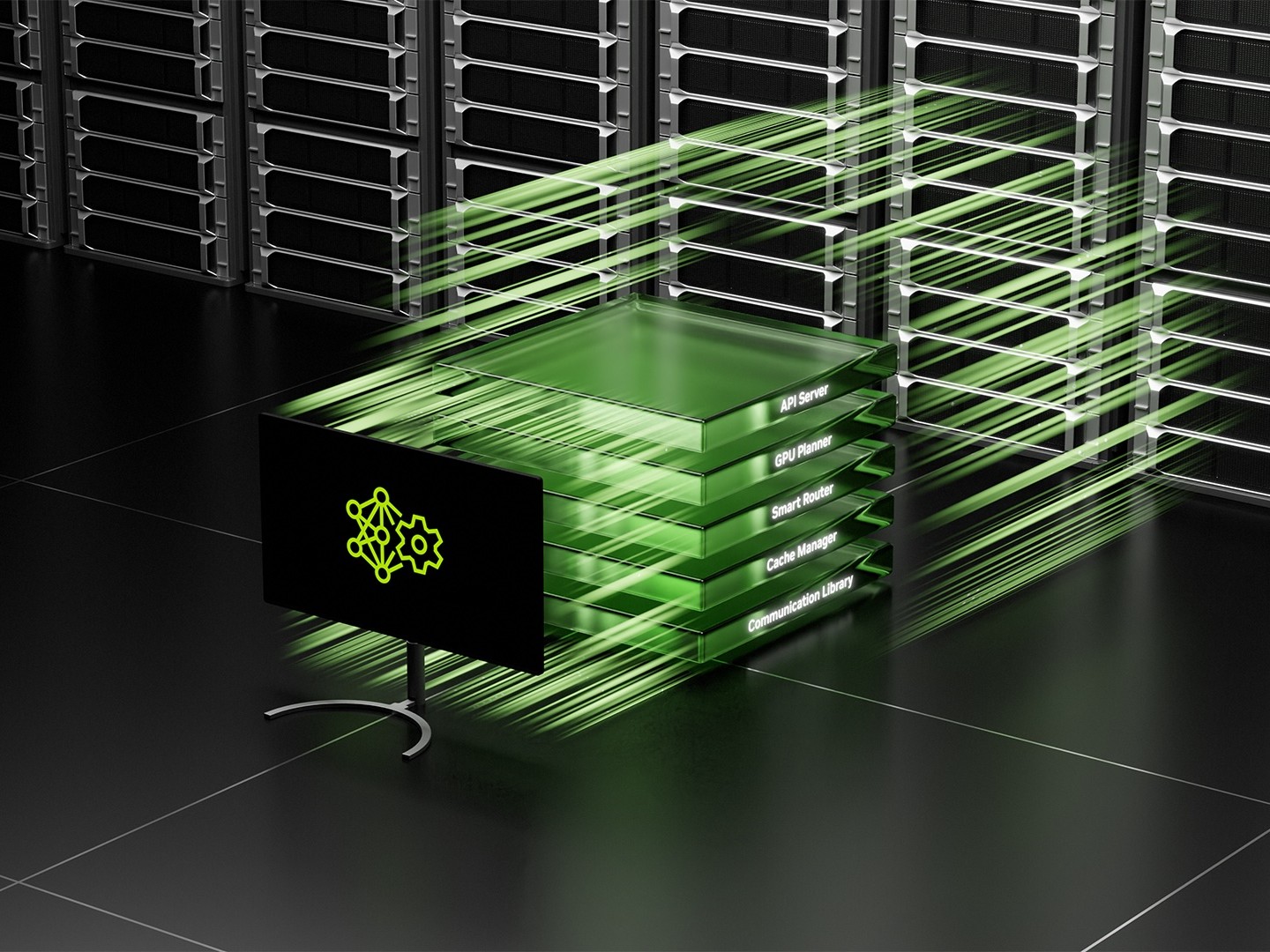

Scaling AI Infrastructure for Fintech

Scale is a crucial consideration while leveraging technology. Fintech firms are increasingly building customized AI/ML pipelines that can adapt as use cases evolve. A multi-model orchestration approach ensures that tasks like OCR, fraud scoring, and biometric validation are paired with the best-fit model, avoiding a one-size-fits-all approach.

Internally, for engineering teams, AI also serves as an invaluable co-pilot, freeing engineers to solve bigger, more complex challenges. Automated analysis engines complete in minutes what used to take days, allowing engineers to focus on strategic, high-impact projects. Root cause analysis also becomes significantly faster with AI, resolving issues with minimal human intervention. The result is an agile fintech infrastructure that scales effortlessly and delivers quicker, more efficient services to merchants and consumers alike.

Reusable frameworks and developer-ready pipelines also reduce the time-to-market for new solutions, ensuring that businesses can rapidly adopt future technologies without disrupting existing systems. With trust, speed, and personalization as guiding principles, fintech is prepared to shape the next decade of digital finance.

According to Grand View Research, AI in the Indian fintech market generated a revenue of USD 462.8 million in 2022 and is expected to reach USD 2,340.1 million by 2030, growing at a CAGR of 22.5% from 2023 to 2030 (Source).

The rise of AI and GenAI in fintech isn’t just a technological leap; it’s a well-thought-out imperative. By inserting intelligence into core infrastructure, fintech companies are building ecosystems that are not only secure but also incredibly adaptable. As user expectations and regulatory landscapes evolve, those that invest in robust, AI-driven frameworks will lead the next wave of innovation.

In the end, it’s not just about using AI but about using it wisely, as a catalyst for building scalable, secure, and customer-centric fintech solutions. The future belongs to those who build smarter, faster, and more sturdy systems, and AI is the engine powering this transformation.

The author is Ramkumar Venkatesan, Chief Technology Officer, Cashfree Payments.

Disclaimer: The views expressed are solely of the author and ETCIO does not necessarily subscribe to it. ETCIO shall not be responsible for any damage caused to any person/organization directly or indirectly.

Published On May 17, 2025 at 09:05 AM IST

Join the Community

Join the community of 2M+ industry professionals by subscribing to our newsletter to get the latest insights and analysis.

Download ETCISO App

Download the ETCISO App to get real-time updates and save your favorite articles. Available on Play Store and App Store.

Source Link