According to a report by Axios on Friday, General Catalyst, a prominent venture capital firm, is exploring the possibility of an initial public offering (IPO), as confirmed by “multiple sources”.

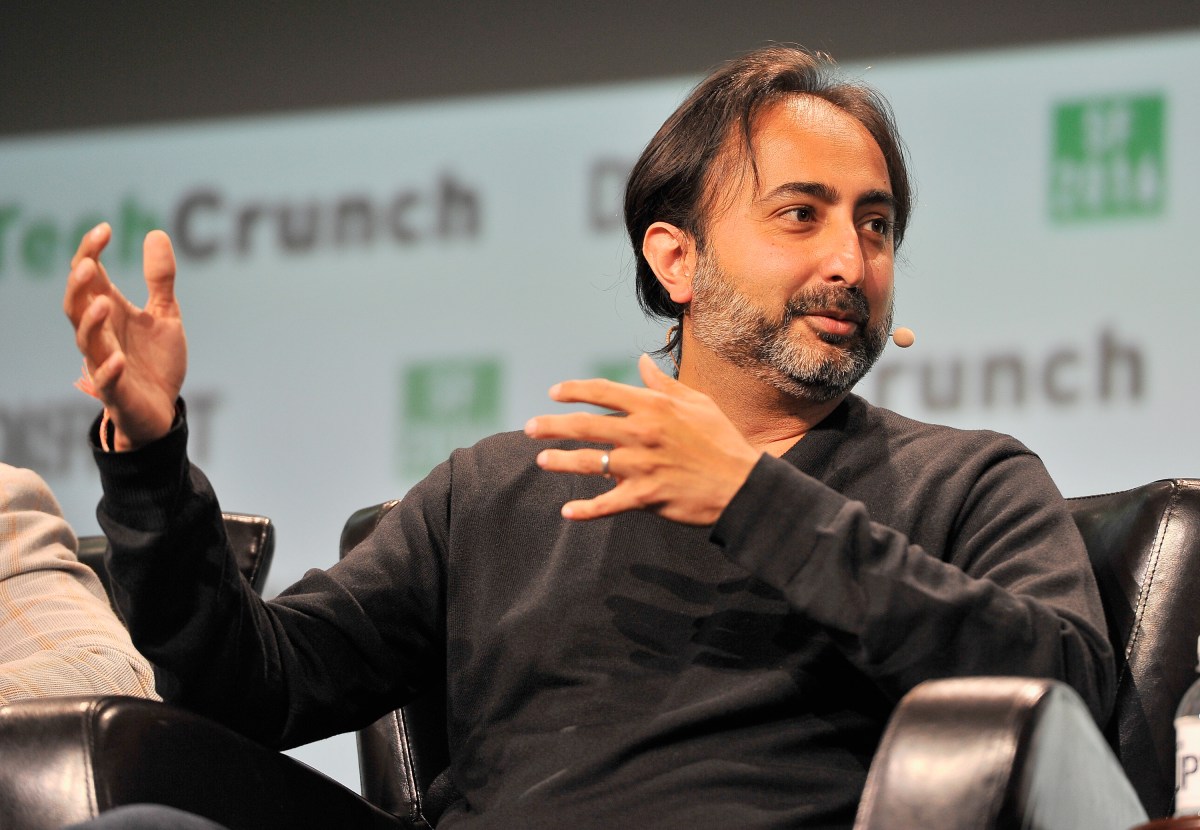

TechCrunch has reached out to Hemant Taneja, the firm’s managing partner, for a statement. Meanwhile, those familiar with General Catalyst’s history won’t be surprised by the prospect of an IPO, given the firm’s remarkable growth and success over the years.

Founded 25 years ago in Cambridge, Massachusetts, General Catalyst started with $73 million in capital commitments. Over the years, the firm has experienced significant growth, with notable investments in software companies like Demandware and Brightcove. In the early 2010s, Taneja and his partner Neil Sequeira established a presence in Palo Alto, where they cultivated strong relationships with Y Combinator, resulting in successful investments, including a stake in Airbnb in 2011. The following year, General Catalyst committed to backing every Y Combinator startup, a move that has yielded substantial returns.

In 2012, General Catalyst led the Series B round for Stripe, a Y Combinator alum that has since become a fintech giant, with a valuation of over $91 billion. Notably, Stripe has stated that it has “no immediate plans” to go public, despite its impressive growth.

General Catalyst itself has undergone significant expansion, with a team of 20 managing directors, over $30 billion in assets, and offices in multiple locations, including San Francisco and Bengaluru. The firm has also diversified its investment portfolio, venturing beyond traditional venture capital. As previously reported, General Catalyst has launched financing products, established a wealth management business, and acquired a small healthcare system in Ohio, among other moves.

A key question posed by Axios is whether General Catalyst will be the first venture capital firm to go public. The answer not only depends on the firm’s decision to proceed but also whether the speculation surrounding an IPO will accelerate the plans of other prominent firms, such as Andreessen Horowitz, which may be considering a similar move.

Source Link